The government of Singapore has done a considerable amount for the people of the Singapore who cannot afford the private homes developed by the many private developers. Through their housing authority in the form of the Housing and Development Board or the HDB, citizens of Singapore have access to the many HDB flats and apartments at exclusively cheap and inexpensive prices. Buying a HDB apartment, however, includes a long list of restrictions that restrain the availability to only those people who have a monthly income ceiling of $12,000.

On the other hand, there are many people who earn more than $12,000 on a monthly basis, and yet not enough to be able to afford the expensive private housing units like condominiums, villas, etc. These people fall under the category which is commonly referred to as the “Sandwiched” population of Singapore. For such people, the HDB has come up with a program that will also help them find homes for their families.

What are executive condominiums?

Executive condominiums or ECs, as they are commonly known, are a form of hybrid homes for the “sandwiched” Singaporean population. These properties are quite similar to private condominiums in the types of housing units or facilities and features on offer. In fact, they are also developed and sold by private developers. However, the entire thing is managed under the supervision of the HDB. Developers receive a number of subsidies and grants when developing these properties. Hence, they are able to sell the properties to these people at much reduced prices, thus allowing these people to afford private homes.

Who is eligible to purchase an EC in Singapore?

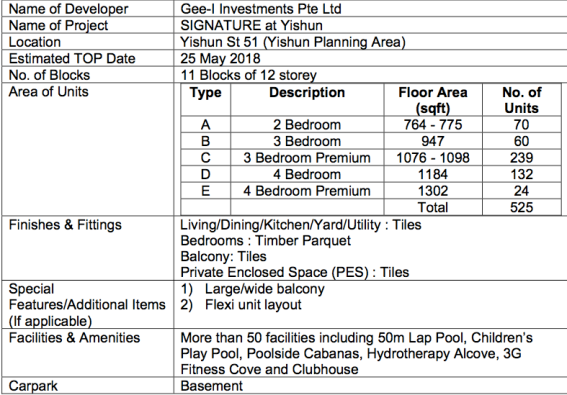

In order to be eligible to purchase an executive condominium in properties like the Signature at Yishun EC Singapore, a person must not have a monthly family income in excess of $14,000. Moreover, they must be a part of a family nucleus comprising of spouses, children, parents, etc. Moreover, if an applicant has previously owned or currently owns a HDB property, they must at least complete the Minimum Occupancy Period of 5 before applying for a second property. in case they have sold the previous property, they must wait for an additional 30 months after the sale of the property before applying for the second property.

Financing options for ECs in Singapore

In order to purchase an executive condominium in a property like the Signature at Yishun, the buyer must pay the down payment of 20 percent of total value in cash. This payment must be made upfront, whereas the buyer can obtain a bank loan to finance the remaining 80 percent of the total value of the property.